Cash Flow Analysis for Florida Dental Practices | Doctor’s Choice

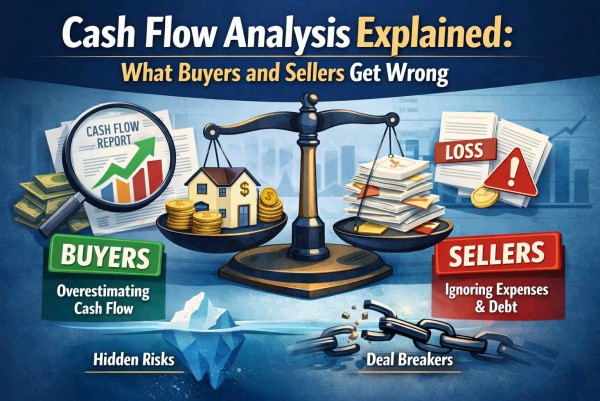

Understanding a Cash Flow Analysis: Hidden Risks for Buyers and Sellers

When evaluating a dental practice acquisition in Florida, the cash flow of the business will be the variable that holds the most weight when determining fair market value. Most financial statements at first glance will look underwhelming due to the fact that most practice owners try to show as little profit as possible to pay less in taxes each year. The goal for the seller when having a cash flow analysis done is to ensure that you go through your general ledger and inform your advisor what is personal and/or a one-time non-recurring expense. In our industry, we call these adjustments or “add-backs,” and examples are outlined below. The goal of the buyer is to verify that the adjustments are true, accurate, and justifiable. We are going to discuss several warning signs and pitfalls that buyers and sellers should identify before moving forward with a purchase or sale.

|

Examples of One-Time Non-Recurring Expenses: |

Examples of Personal Expenses: |

|

● Replacement of HVAC unit ● Replacement of any large dental equipment ● Renovation of office |

● Travel ● Salaries & Wages for family members who do not work at the practice ● Auto expenses |

The Cash Flow Analysis Basics

As noted above, terms such as cash flow analysis, seller’s discretionary earnings, or net earnings all refer to the same core concept: the amount a buyer is expected to take home before taxes, depreciation, amortization, and interest, after removing the seller’s personal and one-time expenses. In simple terms, it reflects how much money a buyer would earn if they operated the practice with the same revenue and expense structure as the seller—before factoring in loan payments for the acquisition or income taxes.

A common mistake among first-time practice buyers, especially without proper guidance, is taking a financial statement at face value. The profit shown on paper is often misleading and, by itself, largely meaningless. An accountant’s role is to help the owner minimize reported income to reduce tax liability, and the degree to which this is done can vary widely from one dental practice and accountant to another.

Why Cash Flow Analysis Is Critical for Sellers

For a seller, engaging a broker or accounting firm to analyze cash flow allows for the proper identification of expenses that can be adjusted, or “added back,” such as vehicle costs, travel, and officer compensation. In many cases, sellers also run personal purchases through categories like office expenses, utilities, or repairs and maintenance. These are common items that often go unnoticed unless specifically reviewed and discussed.

The seller’s objective is to accurately present the highest defensible level of cash flow. As a general rule of thumb, dental practices are often valued at approximately 2.25 times each dollar of profit. By way of example, overlooking $10,000 in personal expenses can result in roughly $22,500 of unrealized practice value.

Pro tip: If you try to go by memory, you will forget something. I would suggest that you obtain a copy of your general ledger for the time period being analyzed and go through it line by line.

Another pitfall is when sellers make estimations. Since you will have to be definitive at some point in the process, we highly recommend doing the work on the front end as this will pay dividends for several reasons. What if a buyer determines during due diligence that you thought your wife’s salary was $70,000 in the trailing twelve-month period being analyzed but when a buyer asks for the payroll report it is actually only $40,000? Now you are working backwards because this would be a hit to the profitability of the practice by $30,000 which would likely be deemed material and potentially cause a buyer to adjust their offer. Furthermore, when a buyer gets a package of information that is clean, current, and accurate it helps create trust and streamlines the process. We see it happen all the time where a buyer requests a document and then it takes the seller weeks to put that together. Buyers often begin to question whether information is being withheld, which can slow down or jeopardize the deal.

Why Cash Flow Verification Is Essential for Buyers

For a buyer, it is critical to validate the larger claimed expense adjustments to confirm they are accurate and supportable. Request source documentation and detailed reports to substantiate what is being represented. As noted earlier, reliance on a seller’s estimates or memory is often where discrepancies arise and diligence issues begin.

By way of example, if a seller’s office expenses are $40,000 but the seller claimed an adjustment of $20,000 because he estimated that 50% of this expense category were personal Amazon expenses, you will want to ask for a list of the seller’s Amazon purchases for the time period being examined to verify. What if you determine that there was only $5,000 in personal expenses instead of $20,000? This would result in a $15,000 hit to the profitability of the practice.

Another issue we see is that some brokers will just start adjusting items like dental lab or dental supplies to an industry norm if certain expenses are above average to inflate the profitability of the practice. This approach is often used to artificially inflate perceived profitability, and in most cases, it is not appropriate. If a seller is utilizing a top-tier lab that is expensive, but they have a cosmetic-driven practice, this lab could be a key contribution to the practice’s performance and reputation. Normalizing or removing it can distort the true operating model and fundamentally alter the character of the practice.

Essential Cash Flow Analysis for Florida Practice Transitions

The cash flow is the foundation of practice value, yet it is also one of the most overlooked elements in a transaction by buyers, sellers, and brokers. We reviewed how sellers can maximize value by properly identifying personal and one-time expenses, while on the flip side highlighted why buyers must carefully verify the larger adjustments through documentation rather than estimates. As we tell all our sellers, make sure your financial statements are clean, current, and accurate.

Get Expert Guidance for Your Florida Practice Cash Flow Analysis

Don’t navigate the complex world of practice valuations alone. Whether you’re buying your first practice or planning your exit strategy, understanding cash flow analysis is crucial to making informed decisions. Contact our Florida practice transition specialists today at (877) 335-0380 to ensure your cash flow analysis is accurate, comprehensive, and maximizes your practice value.